KPSIA

Kenya Private Schools Insurance Agency

KPSIA is a subsidiary investment arm of The Kenya Private Schools Association that was formed with the intention of supporting KPSA members and their activities country wide.

KPSIA is therefore an insurance agency that is registered and licensed under the Insurance regulatory authority (IRA) and has been given the mandate to transact business as an intermediary between the Kenya private schools and insurance companies.

Our Vision

To be an Insurance Intermediary of Choice for schools

Our Mission

To safeguard our Members Progress

Our Core Values

Living Our Promise

We exist for our clients

Flexible to market changes

Clear and transparent

Driven to see you grow

Our Objectives

- Facilitate negotiations for all your insurance products and ensure competitive terms and conditions for KPSA members

- Facilitate for specific insurance products tailor made for KPSA Schools

- Ensure appropriate risk analysis is carried out before a cover is issued

- Ensure that management and claims settlements are done promptly

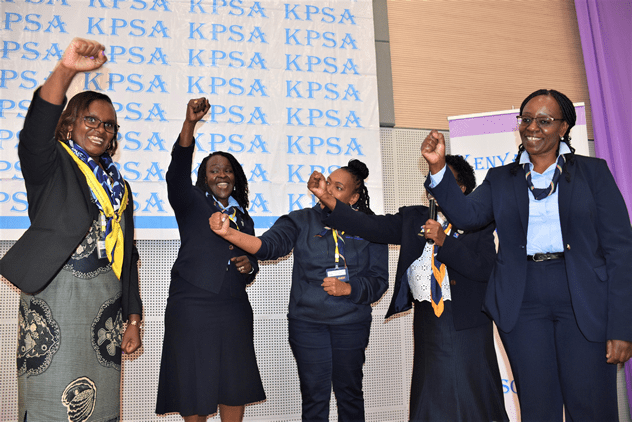

Facilitate training for school directors, teachers, none teaching staff and parents on insurance matters

Many claims are not paid by insurance companied because product consumers aren’t informed on the provisions and exclusions packaged in the product they purchased. Ignorance is no defense as the law states: directors will be given all relevant information before uptake.

KPSIA will therefore organize forums to educate directors on all insurance matters to ensure they get value for premiums they pay

KPSIA will earn commissions from all insurance companies that cover you. The income generated will fund KPSA activities country wide. This will free up time to carry out the core mandate of the association which is lobbying instead of fundraising to serve the association.

KPSIA hopes to grow and there is room for expansion into an underwriting company for the association in future

Product

- Motor vehicles- comprehensive and third party:

-

- Director’s car,

- School buses,

- School vans.

-

- Asset Insurance- permanent structures and buildings

- Medical covers – Individual life covers, Students, staff and Directors,

- Group life covers.

- WIBA Fire and related perils insurance

- Burglary Insurance

- Students personal accident covers

- Public Liability

- Travel Insurance

Conclusion

We are in the process of formulating attractive incentives for school directors who onboard their schools. We therefore need you to help us achieve our goals and objectives.